Hello,

Consult Club, IIM Calcutta is back with Funnel vision, the fortnightly newsletter for all consulting and strategy enthusiasts.

With this newsletter, we aim to take a look at different business models, strategies, trends and much more (historic and new), peppered with examples from around the world to give you a wide variety of second-hand business expertise to draw on in your interviews as well as everyday conversations.

You can subscribe to our mailing list to not miss out on interesting stories from around the business world.

Today, we talk about the changing face of agri-tech in India.

Happy Reading!

The changing face of agri-tech in India

If the economy was the heart of India, agriculture would be the bloodline. It wouldn’t be surprising to know that agriculture forms a major chunk of the Indian Economy, 16% to be precise. It supplies wages to 43% of the Indian workforce. Numerous industries on the likes of consumer-packaged goods, retail, chemicals and e-commerce are heavily dependent on the output produced through agriculture, thereby magnifying the impact of agriculture on the country’s economy.

What’s the need for technology?

Adoption of technology in agriculture (agritech) is helping in solving several pain-points across the spectrum of traditional agriculture value chain, and presents a market potential of US$24b.

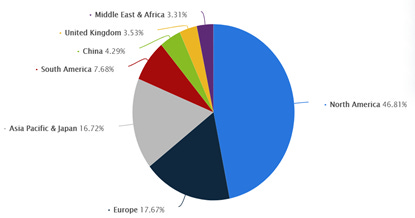

While it remains to be seen how the adoption of IoT in agriculture ensues, the projections show a fast increasing trend, to about $22 Billion in 2025, with North America taking the biggest chunk of the pie.

AgriTech is the idea of applying modern technologies to the agricultural sector with a view to enhance produce, efficiency and revenue. The concept extends to any applications, practices, products and services that enhance any aspect of the agricultural process, be it an input function or the output received.

Startups are targeting the various stages of the agricultural chain process. Here are few categories:

Crop inspection -Using drones/technological advancements like Satellite imaging ,to detect outbreak of pests ,diseases or locust infestation.

Recommendation systems-These startups focus on timely updates on the right time to sow and harvest ,based on climatic conditions and weather patterns

Supply Chain -Companies involved in the agri chain are usually involved in the timely procurement, transport and last mile delivery to the customer.

Startups based on Supply Chain Model/Market Linkage Model

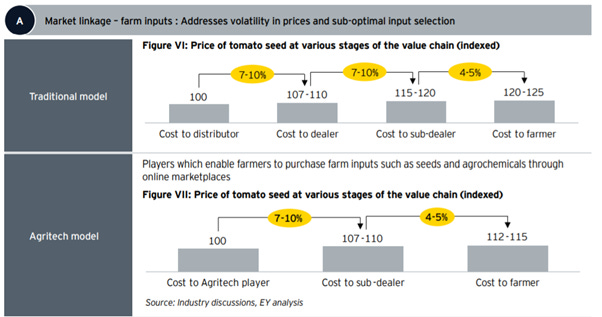

Innovations must be included to help farmers with timely and accurate estimation of sowing and harvesting in sync with consumer demand patterns. Such linkages operate at the two critical ends of the supply chain: input and output models. These models aim to link producers to remunerative sourcing agencies for procurement and to profitable buyers for output sales. Indian agriculture is supply driven and less market-driven compared to other markets. This is the primary reason for seasonal food inflation as well as significant food waste and value loss along the supply chain. Though demand is becoming more predictable in India given the homogenization of consumption trends, supply is less predictable. This presents an opportunity for developing supply chain/market linkage models for farmers. This in turn could require innovations to help farmers with the timely and accurate estimation of sowing and harvesting in the context of patterns in consumer demand. Sabziwala, MeraKisan, Dehaat are some of the startups who have demonstrated successful aggregation in horticulture. There is need to optimize these supply chains for effective solutions that can preserve the quality, reduce waste, improve traceability, and improve shelf-life efficient aggregation, transportation and storage, etc. The Supply chain model/market linkage model can be further divided into two sub models:

Upstream (Input) Marketplace model: It matches agri input sellers to farmers upwards in the agricultural value chain. Bighart, AgroHub, Crofarm are some of the startups in this category.

Downstream (Output) ‘Farm-to-Fork’ supply chain model: Matching farmers to businesses or retail customers for fresh produce, processed food. Ninjacart, Bharat Bazaar are some of the names in this category.

Points to Ponder over

The internet penetration is increasing in rural India with ~57% of rural users accessing the internet for 15 to 30 minutes daily. With this, farmers are getting timely weather alerts along with historical data about crop diseases, standard best practices and output forecast. Indian agritech market potential is estimated at ~US$24b; current market penetration is ~1%. There is an opportunity for multiple startups to innovate and tap into this market.

Will India become the next tech giant in the booming agritech space?

Meet the Author

This issue of Funnel Vision has been penned by Jaskirat Singh.

Around the web in 5 stories

Even as Zomato went public, in a reminder that it plays in a tough market, its close rival Swiggy closed a $1.25B Series J round led by Softbank and Prosus. This is Softbank's first foray into the food delivery space in India.

More startup IPOs are coming, with the latest addition being Policybazaar, which is looking to raise up to $870M through its IPO. The online insurance aggregator is seeking a valuation of as much as $5 billion.

China has decided to ‘overhaul’ its EdTech industry, banning companies that teach school curriculums from making profits, raising capital or going public.

India might have a digital currency soon, with the RBI planning to conduct pilot projects in the near future.

Byju’s continues its acquisition streak, with Great Learning and Toppr being the latest addition. It has shelled out more than $2.2 billion in acquiring complementary businesses in 2021.

That’s all for this week!

Do follow us on Instagram and LinkedIn.

If you liked what you just read, please subscribe to have Funnel Vision directly delivered to your mail.