Ford Motors exited India a few weeks back, adding to a list of automobile OEM exits from India. In this edition, we look into the reasons behind the exit and what should be done to make the Indian market attractive for the world’s auto majors.

The automobile industry has been a solid contributor to the Indian economy for a considerable time. It contributes 7.1 percent to the overall GDP of India and 49 percent to the manufacturing GDP. With the second-highest population in the world, India is the fourth-largest auto market in the world. A significant cause of concern is the declining CAGR for the last three decades, which has only amplified in the last decade. This slowdown, big players' market domination, and other factors have forced major global players to leave the Indian market. Hence, India has emerged as a graveyard for the world's auto majors.

The Exits

Apart from the exits mentioned above, Honda Cars have stopped manufacturing in one of their plants, and Toyota has made announcements saying that they won’t be expanding their investments in India.

What’s wrong with the Auto Sector?

New entrants vs incumbents

The top 3 players in the passenger car market - Maruti Suzuki, Hyundai and Tata collectively have over a 70% market share. Asian automakers have tasted more success than their American and European counterparts. The Asian automakers with markets closer to Indian markets have been better at coming up with products suited to Indian needs.

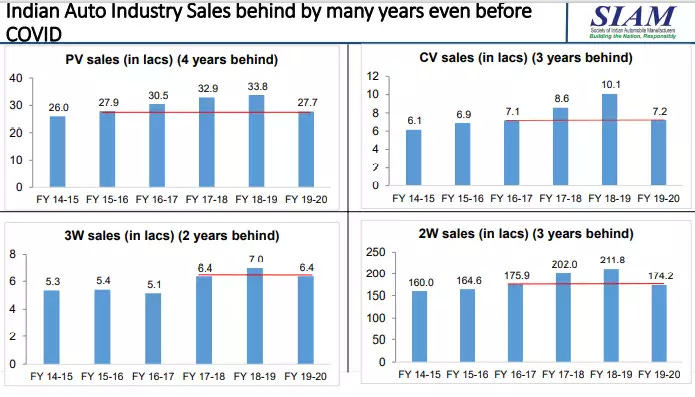

Sluggish industry growth

A major cause of concern is the declining CAGR. Although the slowdown has persisted for the last three decades, from 12.6% in the 90s to just 3.6% in the previous decade, the last five years were especially troublesome for the industry. The decline was prominent even before the COVID pandemic struck. The sales even saw a decline in FY 19-20. Even though India is not the only market-facing this issue, the slowdown is steeper than in other nations. This steep decline is attributed to various reasons such as environmental regulations, fuel price hikes, NBFC crisis. The mandate to use BS-VI engines instead of the BS-IV engine increased the cost of production for the companies, which was only partially passed on to the end customer. This decreased the number of sales as well as overall margins for the companies. COVID was also a major trigger in slowing down sales. The shutdown of production at OEM(original equipment manufacturers), disruption in the entire value chain and an overall decrease in demand due to pandemic induced lockdown lead to a decline in sales.

Economies of scale

Ford shut down its India operations after being unsuccessful for 20 years. In the financial year ending March 2019, Ford had a mere 2.75% market share and operating losses worth $2B. Cost-cutting is a key exercise for any automaker aiming to enter the hyper price-sensitive Indian market and economies of scale play an important role in achieving it. Most European/American car companies however aren’t able to reach desired scales leading them to not have competitive prices. Ford operated at only 20% of its production capacity, clearly highlighting how its sales targets were disastrously away from actual sales.

Govt regulations - High taxes

The Indian govt. charges notoriously high tax rates from car manufacturers which further makes it difficult for new entrants. Officials from Audi mentioned that India constitutes 1% of their units sold and 10% of revenue. This has time and time again deterred many auto manufacturers from entering India.

Unique customer - Extremely price-sensitive, prefers small compact cars

Consumers in India care a lot about the marginal value they get from spending extra money on automobiles. They want more for less. However, they are ready to pay for something that ultimately delights them, like an air conditioner or a power steering wheel. Indian customers believe in word-of-mouth advertising far more than fancy advertisements. More often than not, multinational companies try to bring in global solutions here which don’t work. What an Indian market actually wants is a unique tailored solution.

What should the foreign auto manufacturers do?

American/European manufacturers often fail to introduce India-centric cars. Rather than focus on fuel efficiency for the mileage obsessed Indian customer Ford concentrated on engine power and performance. The rate at which new models are introduced too lags behind market leaders Maruti and Hyundai. Ford was slow to increase its service centers across India. Kia, which entered much later than Ford, now boasts half the no. of service centers of Ford. The low-cost automobile segment suffers from a lack of models from Ford, GM, and other European/American companies. Ford’s management too was distant and uninterested. Perhaps having an outsider as the CEO of Ford India hampered the company's capacity to successfully communicate with Indian partners. Ford's India endeavor was run by foreigners at the top, which was a differentiation in a market where pricing and relationship were important.

What should the government do?

The steady exit of auto companies threatens numerous jobs and is a matter of serious concern. Ford’s exit alone risks the capital invested by dealers across India and threatens as many as 60,000 jobs. The exit also makes other companies thinking of investing in India cautious. The Indian automobile space too is made less competitive and Indian consumers are presented with fewer options. One major concern that has been pointed out by numerous companies is that of the extremely discouraging tax structure. Elon Musk tweeted the same to be the reason for Tesla not entering India as of yet. A revision of taxes will thus go a long way in preventing firms from leaving and existing players to continue investing.

It remains to be seen what the future holds for the automobile sector.

Meet the Author

This issue of Funnel Vision has been authored by Anupriy Shrivastava and Siddharth Singh.

Around the web in 5 stories

A lot has been talked about the Evergande crisis in China, with many equating it with the 2008 Financial Crisis. This article has a brief explainer of the crisis, which has been brewing for many years.

Two of India’s major entertainment houses announced a merger last week. Read this article to know more about the Zee-Sony merger.

The Ken wrote an interesting piece on the B2B edtech space and how the incumbents plan to operate in the post-pandemic world. You can read it as a follow-up to our last article on the post-pandemic edtech space.

The government announced a rescue package for the Telecom Industry, with a moratorium on the AGR dues, helping Vodafone-Idea from a potential disaster.

TCS announced a rather interesting re-opening plan, with about 75% of employees expected to work from home on a permanent basis. Read this article to know more.

That’s all for this edition!

Do follow us on Instagram and LinkedIn. Stay connected for insightful articles lined up for this year.