It’s common sense to think that if you’re going to launch a brand, product, or new variant, you’d want it to perform well. Apparently not always. Today, let’s look at a couple of brands, designed to fail and how they took others down with them.

TaB Clear - A Clear Craze

In the 1990s America, companies wanted to make “clear” products. Transparent cases on Game Boys and glycerine soap ruled the shelves. Add to the mix, Crystal Pepsi, a variant of Pepsi that was completely colourless, but with that same Pepsi taste.

At the height of the clear craze, Crystal Pepsi was launched in April of 1992, and in its first year captured a full percentage point of US Soft Drink sales (that’s about $474 million dollars of revenue). This is even more remarkable considering that they only launched in 5 cities for the first 8 months.

Now, B-school will teach you that when confronted by a new brand that’s making headway in the market, you either a. Try to make a better product in the category, b. Make a cheaper product or c. Reposition. But Coca-Cola’s CMO at the time Sergio Zyman had transcended conventional B-school knowledge.

Clear Failure

“A way to ambush Crystal Pepsi is to do a kamikaze on them – commit suicide and kill them in the process” - Sergio Zyman

Coca-Cola wanted to do this without damaging the Coca-Cola brand. Instead, they decided to use their 4% market share brand TaB as a sacrificial pawn. In late 1992, media reporters gathered for the press conference of what Coca-Cola was touting as a “truly out-of-this-world experience.” The product was called TaB Clear and was marketed as a new version of the sugar-free and calorie-free diet drink which they first sold in 1963. But what they were really trying to do was launch an unexciting sugar-free diet drink which tried to closely associate itself with Crystal Pepsi, making both products look like unexciting sugar-free diet drinks. While North American head Doug Ivester bragged that TaB Clear would be another success for Coca-Cola, he and Zyman already knew that TaB Clear would be a failure.

Fizzling Out

TaB’s future was clear, Coca-Cola rolled out the products with the sole purpose of product suicide, killing Crystal Pepsi in the process. TaB was able to successfully associate itself with Crystal Pepsi. “I would guess they (Coca-Cola) are trying to piggyback on the success of Crystal Pepsi, to some extent,” said an analyst at a leading investment bank at the time. Within 6 months of TaB Clear’s launch, both products were pulled off the shelves.

Coca-Cola had successfully ended the clear soda craze. It just goes to show that the Cola Wars were not limited to fun advertisements. Coke and Pepsi fights are like car crashes, you just can’t look away.

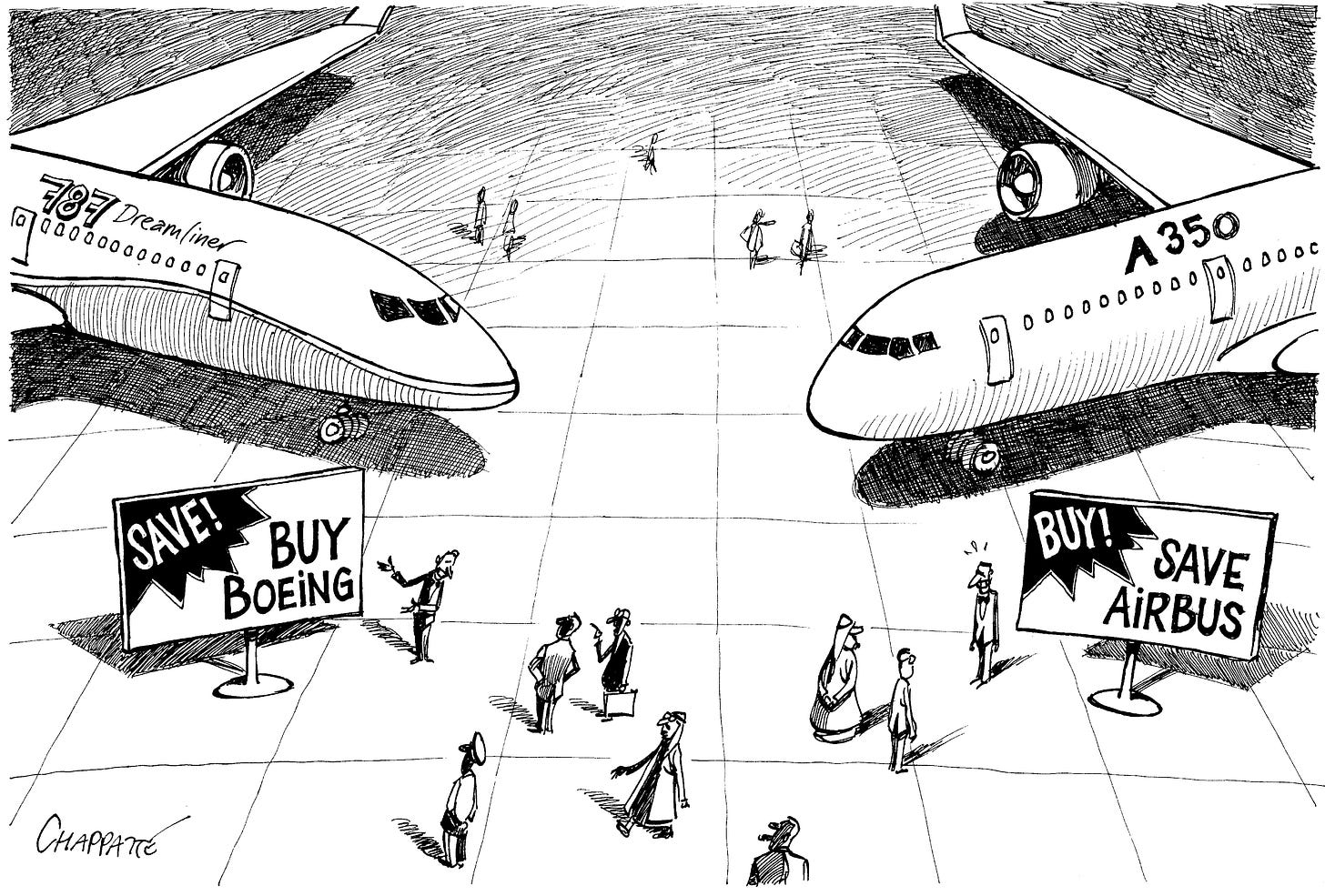

Boeing Sonic Cruiser - A Tone-Deaf Idea?

While Coca-Cola proudly touts the TaB Clear ploy, I don’t think many head honchos at Boeing would ‘fess up to their little tactic, but many believe that the writing is clearly on the wall.

Creating a new aircraft is no easy job, there’s tons of R&D cost that goes into it, not to mention the opportunity cost of missing out on other potential avenues. Boeing knew this, of course. This is why then CEO Alan Mulally unveiled the Sonic Cruiser, at a press conference, in the hopes that Airbus, its European rival, would take the bait.

The Sonic Cruiser was supposed to be a mid-sized, high-subsonic speed aircraft that would have a top speed of Mach .98. It was seen to be the next big thing by Boeing, and Airbus felt they had to make a competitor. So, Airbus poured billions into making their own Sonic Cruiser variant, the A380. But what Boeing secretly knew all along was that the Sonic Cruiser would cater to an extremely small market, and would get lukewarm demand, eventually failing. They spend very little on R&D and had no intention of actually going ahead with the project.

Boeing eventually cancelled the project, leaving Airbus with a white elephant created by FOMO.

Was Alan Blowing Smoke?

Have a look at this video, and decide for yourself whether this was a ploy on Boeing’s end.

Here are the reasons many believe he’s feigning interest in the project:

It’s supposed to be a multibillion-dollar innovation, yet he seems to lack the enthusiasm most CEOs would have

Aviation is a generally risk-averse industry, and yet the CEO of the company is calmly introducing this new aircraft catering to an unproven market need

He says, “it will be of interest for the next couple of years” when a project of this size would definitely only reap profits a decade or two down the line

The Aftermath

Boeing pulled the plug on the project a few months after Airbus started producing the A380. They then went on to produce a more conventional aircraft, the 7E7, which has outsold the A380 by 4:1.

To sum up, some brands are built to fail. One could argue about the morals and ethics associated with that, but this kind of competitive warfare happens every day. But does that mean it should? I’ll leave you to ponder about it.

Meet the Authors

This week’s issue of Funnel Vision has been penned by Tigran Wadia.

Around the Web in 8 Stories

Tiger Global Management, the NY-based American Investment Fund, has been quite active in India of late. Just last week, they participated in four investments in the country that would value each company over $1B dollar - CRED on April 6th, Groww on April 7th, ShareChat and GupShup on April 8th. What is also happening, which is less talked about, is that the investment firm is also targeting seed companies in the country and pre-empting their Series A rounds

“Value is in the eye of the beholder” — Owning something scarce makes one feel unique, and signals success and worthiness as a potential mate. Read Prof. Galloway’s take on non-fungible tokens (NFTs) and how it reflects a digital-native approach to credible scarcity

Here’s a stunning piece on the rise and fall of the missed call economy in India. Leaving missed calls — effectively using a mobile phone as a kind of latter-day pager — was a consumer hack that, in the 2000s, before India’s cheap smartphone and data revolution, grew more popular than texting. It emerged as a critical means of communication for those who counted every rupee spent on recharge credit

Indian startups are coming of age. TAMs have grown, companies are larger and public markets beckon into adulthood. As they grow in scale and size, their need to access deeper and more diversified pools of capital increases. Check out Sequoia’s framework that founders, shareholders and boards can use to choose the best listing venue for their startups

Facebook’s trying to build in responsibility during the product design stage itself rather than the usual “oops, how do we fix this now” we’re used to

Influencer marketing is increasingly becoming a standard line within brands’ marketing plans. But how do you define the return on investment on influencer spend? TL;Dr.

The killer use case for AR/VR might just be warfare. Microsoft announced that it has received a contract to outfit the United States Army with tens of thousands of augmented reality headsets based on the company’s HoloLens tech. This contract could be worth as much as $21.88 billion over 10 years, the company says

The use of regional languages on social media (including why Koo's local language positioning is at best a marketing gimmick), and in advertising is gaining traction

That concludes the last issue of Funnel Vision for this academic year. We’ll be back with more interesting articles for you to read soon.

Meanwhile, stay healthy, stay safe, and don’t be foolish.

Do follow us on Instagram, LinkedIn, and Twitter.

If you like what you read, please share and subscribe to have Funnel Vision directly delivered to your inbox.

Bye!